Business Valuation Methods – How to Value a Privately-Held Business

Business valuations are as much art as they are science as it’s open to several interpretations and estimations on potential future outcomes of a company. Business valuation for privately held businesses in particular is more challenging due to the limited information that can be used to determine the fair market value of a business compared to the data available for public companies. That being said, there is still a framework that professional appraisers will operate from that contains generally accepted methods to value a privately-held business, and depending on the available information and relevant case facts will determine which method(s) are applicable.

First, there are 3 different valuation approaches to value a business, the income, market, and asset approach. Within these, the most commonly applied methods are:

- Income approach: based on a future income stream brought to the present value. Methods applied are:

- Discount Economic Income Method

- Capitalized Economic Income Method

- Market approach: based on comparable transactional data available of public or private businesses as guidance to determine the business’ value. Methods Applied are:

- Guideline Public Company Method

- Guideline Transaction Method

- Asset approach: based on determining a balance sheet of the business adjusted to fair market value. Methods applied are:

- Asset Accumulation Method

How are these business valuation methods applied?

Income Approach – Discount Economic Income Method: Commonly known as the DCF method, usually this method is applied when the company has a volatile historical financial performance or there is a reasonable expectation for significant increases or decreases in financial performance to occur in the foreseeable future. This method uses three main variables,

- projected economic income within a forecasted period of, usually, 5 to 10 years. Appraisers will generally use net cash flows to invested capital which refers to the amount of cash flow generated prior to consideration of how a company is financed,

- projected economic income that is into perpetuity, in line with the company’s historical financial performance, position, and management expectations, and

- a discount rate to bring all projected economic income to the present value. (present value meaning today’s value of future earnings, a dollar today is worth more than a dollar in a year’s time).

The discount rate is a measurement of the risk associated to the future earnings. It’s affected by several different factors such as the company’s historical financial performance and position, macroeconomic and industry landscape, size of the company, and specific factors isolated to the company that are not captured elsewhere, among others. The rate represents the required rate of return that an investor would require of the business for the risks associated with it. All investments carry risk, and a privately held business is no different, in fact is often considered a risker investment, compared to treasury bonds, or the stock market.

Example of DCF application

Let’s say that an HVAC company’s revenue is $1 million and are expected to grow annually at a 15% rate for the following 5 years. Afterwards the company reaches a mature stage and starts growing at a rate of 3%, in line with the target inflation of the economy, into perpetuity. Finally, the company’s net cash flows to invested capital (referred to as earnings in this example) will be 10% of revenues (for simplicity, this will include into perpetuity, however often this percentage does not hold with changes to revenue growth and other considerations) and the required rate of return or discount rate applicable will be 20%.

First of the two stages: Forecast Period

First, in order to bring the projected earnings to the present value we apply the following simple formula:

The period refers to number of years into the future that the earnings will happen in. The earnings in the next 5 years will look like this:

We then apply our present value formula to each of the future earnings and the sum all present values. This will result in the following:

Second of the two stages: Terminal Period

Finally, we need to find the present value of the stream of earnings that will continue to occur into perpetuity (usually called the Terminal Period). For this we use the constant annual growth rate of 3% (let’s call it ). For this we find the terminal period value of the stream of earnings into perpetuity first, (before discounting it to the present value), so we apply the following simple formula:

Keep in mind that means the earnings in year 5. The calculation looks like this:

This resulting value will always be as of the last period of the forecasted period, hence period 5 in this example. (The reasoning for this is beyond the scope of this article); It then needs to be discounted to the present value using the present value of earnings formula. To complete the calculation, you must sum together the present value of the forecast period and the present value of the terminal period, shown below. This will yield the value of the Company’s business (commonly referred to as enterprise value).

Income Approach – Capitalized Economic Income Method

Usually, this method is applied with stable and mature businesses where there are reasonable expectations that no significant changes to the company’s financial performance or associated risk level will happen in the foreseeable future. This method follows the same logic of the prior one, but the earnings measures are expected to grow at constant rate into perpetuity; meaning there is no initial period of volatile change. This stream of earnings is brought to the present value using a capitalization rate which is calculated as the discount rate (same as the one in the DCF method) minus the constant growth rate at which the earnings are expected to grow consistently into the future.

Example of Capitalized Economic Income Method application

To keep it simple, we will continue with the previous example and keep the same revenue of $1 million and 10% earnings as a percentage of revenues. There won’t be any high growth in the following 5 years, only a constant growth into perpetuity of 3% (also referred as in this example) and the same discount rate of 20%. The formula most commonly applied is:

As you can see the formula is very similar to the terminal period from the DCF example. This would then result in the following:

This method is much simpler than the DCF method as you can see. Again, you should be able to easily replicate the results following the formula.

Market Approach – Guideline Public Company Method

This method leverages the vast amount of publicly available data of public companies to find suitable comparables to the company being valued. The basis for comparability depends on the industry where the company operates, operational similarities, size, profitability, or any other criteria depending on specific case facts.

Once comparable companies are found, the appraiser uses valuation multiples of different measures, generally being price-to-revenue, or price-to-EBITDA (earnings before interest, taxes, depreciation & amortization), among others, creating a range of valuation multiples. Finally, a valuation multiple is selected from this range based on the company’s historical financial performance and other qualitative specific analyses relative to the case facts and the selected public comparable companies.

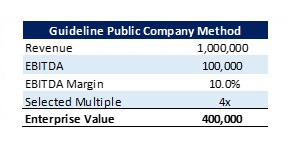

Guideline Public Company Method Example

Let’s continue with our same HVAC company making $1 million, but we will now use EBITDA equal to 10% of revenues (or 10% EBITDA margin). Now, let’s assume that we found similar companies with significantly larger revenues, with the following EBITDA margins and the price-to-EBITDA (or EBITDA multiples) looking like this:

We can see here that the public comparables EBITDA multiple (price-to-EBITDA) grows as profitability increases (this does not always happen but we want to keep things simple). Now, reviewing that our company has a 10% EBITDA margin and its revenues are much more smaller than the public comparables’, all else equal, we can choose a 4x multiple. Again, the analysis will usually be more complex, but we will assume the 4x is applicable for simplicity.

Now all we have to do is multiply our company’s EBITDA by the valuation multiple selected. The result will be:

Market Approach – Guideline Transaction Method

Different to the guideline public company method, this method uses transactional data from privately held comparable companies. Such data is harder to find but there are some databases with sufficient information to search comparable companies. The basis of comparability is the same as with the prior method, based on the range of multiples derived from the comparable private companies, one multiple is selected and applied based on the same criteria as with the prior method.

Guideline Transaction Method Example

Let’s use our guideline public company method’s example but instead of public companies, we have private companies with similar revenues to the company we are valuing. The variables of the private companies will be the following then:

As we can see profitability margin is the same but they trade at lower multiples, often because the market associates higher risk due to the smaller size of the companies and lower quality information that accompanies privately held companies, (however, this is not always the case). All else equal, considering our company has a 10% profitability margin, we chose a 4x multiple. The final valuation will look like this:

It’s important to keep in mind that these methods from the market approach are considered more relevant as the number of comparable companies found grows (meaning more data points makes it more reliable). However, if a small set of highly comparable companies is found, the results of the application of the methods can be as relevant as the results from the bigger set of comparable companies.

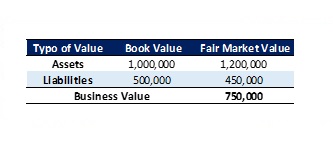

Asset Approach – Asset Accumulation Method

It’s more commonly applied when a business will be liquidated, but there are cases when it’s applicable for businesses expected to operate into perpetuity. In the Asset Accumulation Method, the appraiser will restate all the assets and liabilities of the company being valued to an appropriate standard of value (let’s assume fair market value). After the revaluation of all assets and liability accounts, the analyst can then apply the assets minus liabilities formula to indicate the value of the total equity.

The reason why we need to restate the values to fair market value is because values as shown in the balance sheet are accounting values and may not be reflective of their fair market value. The process of going through each value is very exhaustive and can be extremely difficult to do so for certain types of assets, and may need specialist appraisers for specific assets (like machinery and equipment appraisers, or real estate appraisers) to properly apply the method.

Asset Accumulation Method example

Continuing with the HVAC company, let’s assume it has the following assets and liabilities and their respective fair market values will be as shown:

Shown like this, the method looks simple, but it can become extremely complicated and there may also be assets not recorded on the balance sheet that could be missed. Examples can be brand recognition, intellectual property such as patent and copyrights, among others. These are called Intangible Assets, and they can be hard to identify and value, requiring the skills of a specialist intangibles appraiser.

Our Thoughts…

When valuing a business, all valuation approaches must be considered and one or more can be applied, depending on the case facts and available information. On the surface the methodologies may seem simple enough; however, this article only scratches the surface to the depths of knowledge required for their correct application, where a very experienced and competent appraiser is worth their weight in gold. All valuation purposes benefit from an experienced and competent appraiser, but the riskier the situation (money on the line) the more competent appraiser you will want to hire.

Furthermore, for privately held business valuations, there is one key concept being discounts, which is often applied and that we have not touched on. See our article here that explains discounts for privately-held businesses, which can subtract up to 70% of a business value (very convenient for tax purposes).

If you would like to know more, speak to one of our accredited appraisers.