Quick Ratio

This post will take a dive into the concept of the quick ratio and its interpretation, along with an example.

The quick ratio, commonly referred to as the acid-test ratio, measures the ability of a business to pay its short-term liabilities using only the current assets that are readily convertible into cash. These “quick” assets are mainly cash and cash equivalents, marketable securities, and accounts receivable.

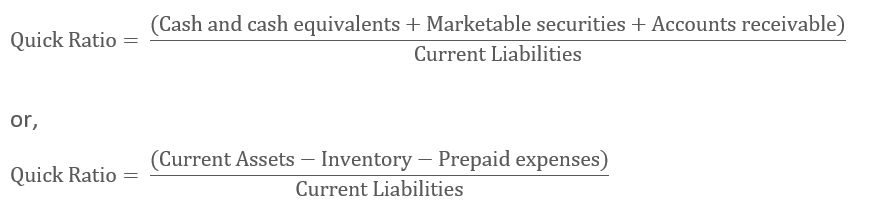

Quick Ratio Formula

As observed above, the quick ratio measures a company’s capacity to pay its current liabilities without needing to sell its inventory or obtain additional financing.

Inventories are excluded from the quick ratio, as it may take too long to convert inventory into cash to cover pressing liabilities. Also, prepaid expenses are excluded, as they cannot be used to pay other liabilities.

Interpretation of Quick Ratio

Generally, the higher the quick ratio, the better it is for the business. However, one must note that quick ratio is an indicator of solvency of an entity, and must be analyzed over a period of time and also in the context of the industry the company operates in.

A quick ratio that is greater than industry average may suggest that the company is investing too many resources in working capital that may be used more profitably elsewhere.

A quick ratio that’s lower than the industry average may suggest that the company is taking too much risk by not maintaining an appropriate buffer of liquid resources. Alternatively, a company may have a lower quick ratio due to better credit terms with suppliers than the competitors.

An Example of Quick Ratio

Company XYZ holds the following:

- cash and cash equivalents – $15 million

- marketable securities – $10 million

- accounts receivable – $20 million

- inventory – $35 million

- short-term debt – $10 million

- accounts payable – $20 million

- income tax payable – $30 million

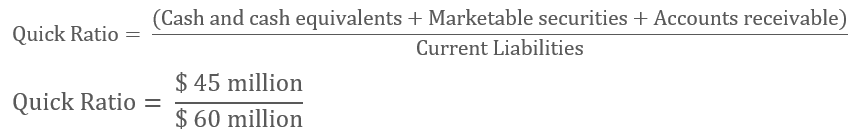

Therefore, the quick ratio will be calculated as such:

Quick Assets = Cash and Cash equivalents + Marketable Securities + Accounts Receivable

Quick Assets = $45 million

Current Liabilities = Short-Term Debt + Accounts Payable + Income Tax Payable

Current Liabilities = $60 million

Thus:

Quick Ratio = 0.75

This means that company XYZ will be able to pay 75% of its current liabilities using assets that can be readily converted into cash.