Market Approach

What Is the Market Approach Valuation?

The market approach valuation is one of the three approaches to value a business, along with the cost approach and income approach. In simpler terms, the market approach determines the value of a business based on the price of transfer or the value of comparable businesses (or even the same business).

This valuation approach leverages the principle that the price of an asset should be the one at which similar assets are traded or valued.

For example, if one apple costs $1, what price should the other apple be if it has the same characteristics on the same day in the same supermarket? The answer is $1. You wouldn’t use the price of an orange to compare to the apple to try determine the price of the apple, as they do not have similar characteristics.

It works the same way for businesses but has an added complexity, since you need to consider factors such as:

- the date at which the comparable businesses were sold or valued,

- the comparability of the businesses to the one being valued, and

- expectations of the industry and economic conditions in which the business operates, among others.

Some comparability points between businesses are:

- revenue levels

- earnings/profit levels and margins

- geographic area of operation

- economic and industry conditions at the date of transaction

- total assets value

- management’s capabilities

- customer concentration/diversification

It’s very unlikely that two businesses are identical in terms of all possible measurements/metrics. However, if there are enough similar characteristics to the subject business, found in enough transactions (often needing several transactions and not just one as an example), the market approach can be the best approach with which to value a business. This is because the transaction has happened, unlike with the income approach that is using a hypothetical transaction.

Once enough similar businesses are found, one calculates the pricing multiples at which the comparable businesses have been traded and adjusts where necessary to use a pricing multiple for the business being valued.

Pricing multiples are ratios to different metrics of the business. Two of the most used are:

- price-to-sales ratio: the price/value of a business is divided by its sales

- price-to-earnings ratio: calculated by dividing the price/value of a business by its earnings

Once you have the ratios of the different companies or transactions and determine which multiple is reasonable for your company, you multiply it by your business earnings measure, and this will be your subject company’s value. Next, let’s check the different valuation methods, as well as an example.

Market Approach Methods of Valuation

When applying the market approach, experts identify recent, arm’s length transactions that involve a similar public or private business or the same business (if it was sold previously and recently) and develop pricing multiples to use for the subject business. Some of these methods include:

- Guideline Public Company Method: the pricing multiples of comparable businesses publicly traded in the stock market are considered in order to determine your company’s multiple

- Merger and Acquisition (M&A) Method: merger and acquisition data of comparable private companies is used to determine the pricing multiple applicable to your subject company

- Prior Transactions Method: the subject company’s transaction history is used to determine its current price

Market Valuation Example

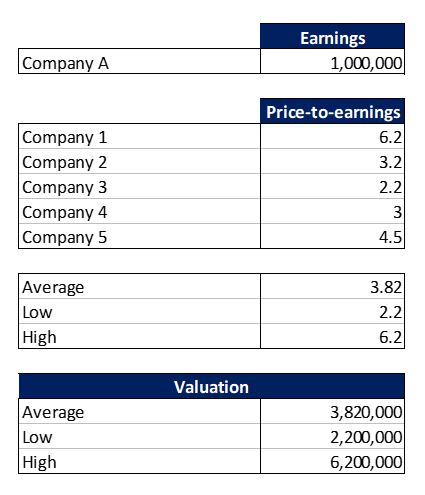

Let’s say that we are valuing company A and we found five comparable companies with the following information:

The above is the information you get from the market (i.e., different earnings multiples where the high can be almost three times the smallest or double the average). To determine an appropriate multiple, you then analyze the operational information of the companies against company A to the determine where company A stands against its comparables based on profitability, growth, revenue levels, etc.

Finally, you apply the multiple you believe to be the most applicable to company A, based on the various points. For example, if we take the average earnings multiple of 3.82 and multiply it by company A’s earnings:

Company A’s Value = $1 million x 3.82 = $3.82 million

Benefits of the Market Approach for Valuing Businesses

The market approach can be the most powerful approach to valuing a business, as you are using prices that the market (different investors) agrees with.

Below are some of the advantages of the market approach:

- the calculations to apply the method are relatively simple. As you can see in the example above, once you have determined which multiple to use, a simple multiplication can suffice

- it can allow the owner to utilize public data which is most often audited which makes it more reliable

- it does not depend on a single subjective forecast, but rather provides the expectations and analyses of several market participants

Some limitations of the market approach:

- for private companies, the availability of information can be difficult

- reliability of the information available

- finding truly comparable businesses

- knowing the exact motivation of the buyer/seller in private company transactions, as one can pay premiums for certain reasons, such as buying your competitor at a premium to have control

Conclusion

The market approach is used to determine the price of an asset by reviewing the selling price of similar assets. It allows you to find a price that has been accepted historically in the market and does not depend on a single forecast which may or may not be accurate. However, for the market approach to be as powerful as it can be, it’s necessary to have reliable and sufficient information in order to derive a reasonable conclusion of value.