How Higher Interest Rates Have Impacted Your Business’ Value

Although interest rate hikes have been meant to counter historical highs of inflation, they are not free of consequences to the economy or businesses. Such consequences have been significant headlines in recent weeks e.g., the 2nd largest collapse of a bank since 2001, SVB, along with the collapse of other regional banks. The U.S. Federal Reserve Bank (the “Fed”) interest rate hikes affect the required rate of return from investors (or discount rate) by increasing a key component of its calculation; this in turn affects the calculation of business values. In this article, we will explain the impacts interest rate hikes have on businesses and their valuations.

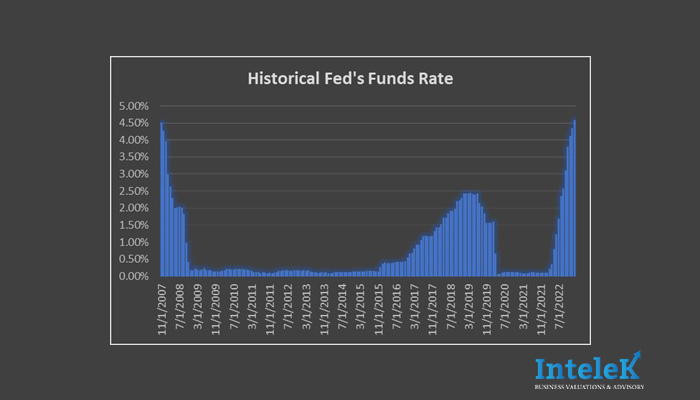

The Fed’s countermeasure for the historically high inflationary environment has resulted in continual increases of interest rates since March 17, 2022, with its latest rate hike being on March 2, 2023. The total increase of the Fed’s fund rate from Feb 2022 to Feb 2023 has been 449 bp, sitting, from 4.75% to 5.00%, and taking the Fed’s Funds Rate back to pre-2008 financial crisis levels.

Note: Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, April 4, 2023.

How Interest Rate Hikes Impact Businesses

Interest rates hikes have direct and indirect impacts on the operations of a business including, but not limited to:

Consumer Demand for Goods and Services Lowers

On a consumer basis, demand for goods and services is negatively impacted. Interest rate hikes may decrease consumption as credit card rates are higher, opportunity costs of consumption in the present also increase as savings rates are more attractive. Another impact on consumer demand for goods and services is the reduction of disposable income due to the periodic increase in monthly mortgage expenses on adjustable-rate mortgages.

Higher Cost to Service Debt

As interest rates rise, the businesses’ interest expense to service debt increases. Some businesses might be running on limited margins or situations where the rise in interest expense can cripple the company. As a result, a business will rethink taking on any new debt or might look for cuts in expenses. If businesses are fortunate enough to have strong demand, they may be able to pass some or all of this on to the consumers.

Slower Growth

Due to higher costs to access loans, businesses will attain slower growth. Funding is key for many businesses to cover working capital or capital expenditure requirements when looking to grow or expand their operations. As a result of higher costs to service debt and uncertainty due to high inflation and interest rates, businesses choose to step back on growth or expansion opportunities.

Lower Investment and Businesses Demand for Goods and Services

As a result of lower consumer demand, businesses stepping back due to higher costs of debt and economic uncertainty, businesses’ demand for capital goods can decline as their income declines, and they choose to be conservative out of fear of a potential recession.

Rise of Unemployment

Considering all the impacts herein mentioned such as lower consumer disposable income, higher cost to service loans, and restricted investments under a period of uncertainty, companies might take the decision to lay off workers.

In summary, the potential consequences of high interest rates for a business are numerous and vary degrading for a country’s economy. However, not all businesses are affected in the same way, and for some, the consequences above are a combination of several factors which may not impact certain industries or companies that heavily; e.g., companies with a good stream of cash flows, sectors with low requirement for debt or with less sensitivity to the economic conditions based on the type of goods or services provided.

How High Interest Rates Impact Business Valuations

Nevertheless, even if a business is not materially impacted by any of these factors and can continue its operations as usual under a high inflationary environment and several interest rate hikes, its valuation can be affected because of the required rate of return or discount rate from investors. This is due to different components in the building of a discount rate or required rate of return such as:

- Risk Free Rate

- Cost of Debt

- Equity Risk Premium

The risk free rate is the rate of return that an investor can receive from investing in a “risk-free” asset. As the required rate of return is built based on a trade-off between risk and returns, if I can get a higher return from a “riskless” asset, would I require the same returns from a riskier one? Generally, a higher return would be required from the riskier asset. A risk-free investment is often considered a treasury (government) bond, of 20 years.

Cost of debt is the effective rate paid for loans or bonds by a business. As the interest rate increases, the cost of debt of a company increases as well.

The equity risk premium (“ERP”) is the additional return from the risk-free rate that investors expect as compensation for investing in a well-diversified portfolio of stocks. E.g., how much more you would expect to earn from investing in a stock index such as the S&P 500 (riskier asset) than the risk-free assets.

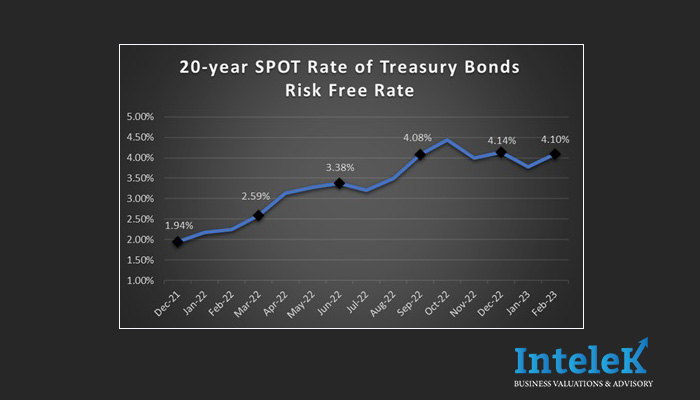

The preferred reference used by analysts for the risk-free rate is the spot 20–year Treasury bonds yield rate. Here are the increases in the risk-free rate from December 2021 to February 2023:

In the case of the cost of debt, it can be determined based on yields from corporate bond indexes (whether investment grade or non-investment grade) or on the Company’s historical average effective interest rate on its loans, among other methods. For example, if we take the ICE BofA Corporate Bond Yield graded BB, the cost of debt went from 3.40% in December 2021 to 7.14% in December 2022.

The Equity Risk Premium (“ERP”) is a forward-looking concept. However, it is an expectation as of the valuation date. Different methods to calculate it include normalized ERP measures from well-known agencies, long-term historical realized ERP, among others. In practice, analysts may not change their ERP based on recent risk-free rates variations but do consider other factors in the calculation of ERP.

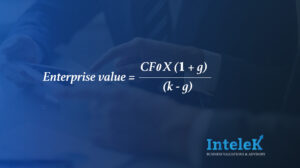

Now, how does all this impact the company’s value? Does a 3% move in the risk-free rate mean a 3% discount (reduction) to the value of your business? Let’s first see a simplified example of how increases in the discount rate can impact a business’ value.

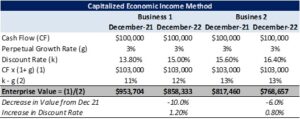

Example 1: How much do increases in discount rate impact a business value.

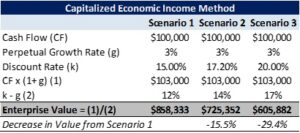

Let’s say we have a small restaurant which is expected to generate $100k in cash flows (referred to as CF) as of the valuation date and these cash flows are expected to grow into perpetuity at a rate of 3% (referred to as g). Let’s explore 3 scenarios, (1) with a 15% discount rate (referred to as k), (2) a 17.22% discount rate (the same as the increase in the risk-free rate from December 2021 to December 2022), and (3) a 20% discount rate.

Using the capitalized economic income method, we will find the enterprise value with the following formula:

The results are as follows:

As shown above, a 2.2% increase in the discount rate, yields a decline in value of 15.5%, and a 5% increase in the discount rate yields a decline of approximately 30%.

It is important to note that, while the risk-free rate has increased 2.2% from December 2021 to December 2022, it does not mean that the discount rate (or weighted average cost of capital “WACC”) calculated for businesses increased 2.2%. The building of a discount rate has many different components which are constantly affected by everyday market factors aside from interest rate hikes. The most used formula to calculate WACC is:

Where:

Ke= Cost of equity

We= Equity as a % of capital structure

Kd= Cost of debt

Wd= Debt as a % of capital structure

t= Corporate statutory tax rate

As explained, the cost of debt will increase as the Fed’s funds rates increase, and as a result, it will increase the WACC. Risk-free rate is a component of the cost of equity. Analysts will generally use the Capital Asset Pricing Model (“CAPM”) to compute the cost of equity, which formula is as follows:

Where:

Rf= Risk free rate.

ERP= Equity risk premium.

Ri= Industry risk premium, measured by calculating the historical relationships between the return of the industry to which the individual asset belongs to and the return of a broad market index such as the S&P’s 500.

CSRP = Company specific risk premium, is a measure of risk which is specific to the company. The factors considered by analysts include size, liquidity, solvency, among other qualitative and quantitative factors.

Per the above formula, as the risk-free rate increases the Cost of Equity also increases; nevertheless, it is not on a directly proportional amount because Industry risk premium, ERP, and a company’s CSRP may vary as well.

To provide you with a real life but simple example, we have calculated the discount rate for the same restaurant with $100k in cash flows considering actual market data as of December 31 2021, and December 31 2022. In addition, we also considered a business (1) which has 20% debt in its capital structure and a business (2) that runs without any debt. The results were as follows:

Example 2:

There are a few things that we can point out from this simple exercise:

(1) a 2.2% increase in the risk-free rate did not equal to a 2.2% increase in the business’ discount rate (while the increase to the cost of equity can be 2.2% in some cases, it would not be a direct consequence of a higher risk-free rate).

(2) business 1, which has debt, exhibited a higher increase in its discount rate (1.20% vs 0.80%), this is as a result of the 20% debt in its capital structure (being leveraged).

(3) Consequently, the decrease in value of business 1 was higher than the decrease in value of business 2.

(4) We can see that whether a business is leveraged or not, in the restaurant industry the risk-free rate has affected its value prior to accounting for any potential changes being experienced in its financial performance and capacity to generate cash flows.

(5) The leveraged business has a higher value than the non-leveraged business, however, this is not always the case. Several other factors that fall outside the scope of this article will come into play.

Please note that this is an overly simplified example to show the impacts of inflation to the discount rate, however, the calculation of discount rates is affected by several factors such as the stage of the business, size, expected future performance, solvency, liquidity, profitability, and several other factors which are recommended to be undertaken by a valuation expert. Furthermore, the impact of interest rate hikes on the discount rates can vary depending on the industry being analyzed as well.

Finally, consider that in the case of privately held businesses this is not the final step to finding a business’ value, as the final result will depend on several factors.

Our thoughts….

One of the main objectives of a central bank is to keep tabs on inflation and make sure that target inflation is achieved. The main instrument the Fed has to control inflation is changing interest rates; nevertheless, a high inflationary environment with high interest rates puts a toll on the economy and businesses as explained in this article. If you’re planning to sell your business, or change its entity structure for estate planning, or look at gifting equity, it’s important to understand how the macroeconomic environment affects its value and speak with your advisors for when the most opportune moment to take action is.

If you would like to understand more, please visit our articles on a successful business valuation engagement, business valuation methods, or how discounts are calculated in business valuation for estate planning purposes and their advantages for tax purposes.