Current Ratio

The current ratio, commonly referred to as the current liquidity ratio or the working capital ratio, is one of the most important liquidity measures to assess a business’ performance. This post will take a dive into the concept of the current ratio and its interpretation, along with an example.

The current ratio measures a business’ ability to meet its short-term obligations that are due within a year. Further, this ratio is a measure of the financial health and solvency of a business, as it indicates how a business can maximize the liquidity of its current assets to settle debt and payables.

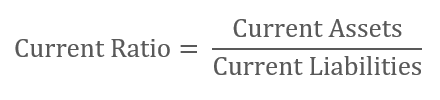

Current Ratio Formula

Current assets are the assets of a company that can be converted into cash within a year. Examples of current assets include cash and cash equivalents, prepaid expenses, inventory, account receivables, short term investments and others.

Current liabilities are short-term financial obligations that are expected to be due within one year, such as lease payments, wages, accounts payables, and short-term bank loans/debt, etc.

Interpretation of Current Ratio

Current ratios vary by industry. However, a current ratio of less than 1 usually indicates that the company’s current liabilities are more than its current assets, and that the business may not be able to cover its short-term debt with its existing short-term financial resources.

A current ratio of more than 1 implies that the company has more financial resources for covering its short-term debt, and that it is operating under stable financial solvency.

When compared to industry standards, an extremely high current ratio indicates that the business is not able to manage its working capital in an efficient manner.

One must note that it is essential to compare the current ratio of a company with its industry peers rather than comparing it in a generalized manner. If the current ratio of a company is considerably less than the industrial average, then one must dig deeper to investigate the cause of that outcome. The same is applicable to companies that have substantially higher current ratios in comparison to their industry peers. Further, an analysis of a company’s current ratio trend over the past years is an important tool one can use to assess business performance. A steady rise in the current ratio indicates that the company is working on improving its liquidity, whereas a decline in the current ratio over the years usually indicates that the financial stability of the company has been worsening.

So then, is a current ratio of less than 1 always a bad sign?

No. One must always consider the industry in which the business operates. An interesting example can be the U.S. supermarket giant Walmart Inc. Over the years, Walmart has maintained a current ratio lower than 1. For the three months that ended April 30th 2022, Walmart’s current ratio was 0.86.

If this figure is examined individually, one may think Walmart must be in financial stress. However, when compared to the supermarket industry in the U.S., this ratio is actually favorable, as Walmart can turn its inventories around and collect its receivables quickly. Therefore, it is not imperative for the company to have a current ratio that is more than 1 in order to do well.

An Example of Current Ratio

Company ABC holds the following:

- cash and cash equivalents – $10 million

- marketable securities – $15 million

- inventory – $35 million

- short-term debt – $10 million

- accounts payable – $20 million

Therefore, the current ratio will be calculated as such:

Current Assets = Cash and Cash Equivalents + Marketable Securities + Inventory

Current Assets = $60 million

Current Liabilities = Short-Term Debt + Accounts Payable

Current Liabilities = $30 million

Thus:

Current Ratio = 2