PEBITDA Versus EBITDA

When discussions of business valuations arise, the terms of EBITDA (or EBIT) and PEBITDA (or PEBIT) invariably become part of the discussion. But what do they mean? And when do you use one instead of the other? Or do they both simply arrive at the same conclusion when finding a valuation figure? If you’re interested in knowing the differences, this article has you covered.

PEBITDA = Proprietor Earnings Before Interest, Tax, Depreciation, and Amortization

EBITDA = Earnings Before Interest, Tax, Depreciation, and Amortization

EBITDA finds an earnings amount of the business before other variables can influence it. This can be thought of as the profit of the business’ operations before non-cash charges and interest affect the amount.

For small to mid-size enterprises (SME), this number tells a story about the health of the business, its ability to generate profit for the owner, and the business’ sustainability. In other words, EBITDA is an important consideration when determining if something is a good investment for someone to buy.

By nature, SMEs operate with a very low but positive EBITDA—or even negative EBITDA—depending on the expense flows of the business for a specific period of time. This is because:

- The owner often pays themselves any profits of the business as wages (hence the EBITDA is often close to $0)

- Existing owner expenses favourably for themselves, and not necessary for the normal operations of the business (company car, travel, entertainment expenses for employees, etc.)

The questions for a potential investor then become:

- First, if I buy this business and pay someone to take the place of the current owner, will I make any profits after I pay this person to run the business? In other words, is it profitable without my day-to-day input?

- Second, if so, what should I pay for this? What is the value? Or if the buyer does want to run the business, how much are they expected to earn as a salary? Is the company profitable after they pay themselves a market salary?

For the SME, using a traditional valuation technique of assigning a multiple to EBITDA designed for larger corporations is not the most appropriate measure due to the unique nature of the SME and the value of EBITDA. For example, think of a small café in which the owner manages the business day to day. Let’s use a multiple of 5 on an EBITDA of $10, which equals a valuation of $50. When the owner is paying themselves $200,000 in wages, this doesn’t seem right, does it? There’s something off about buying a business for $50 that generates a $200,000 wage for the owner.

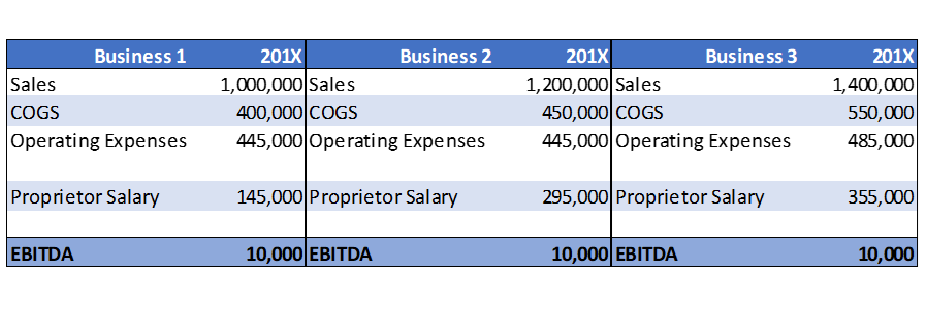

Below is an example of three companies in the same industry, offering the same products and services. When examining three different owners’ wages but all with the same EBITDA, would you value all three companies the same?

PEBITDA finds a better solution to answer this question.

PEBITDA = Proprietor Earnings Before Interest, Tax, Depreciation, and Amortization

The objective of PEBITDA is to find a more accurate indication of the business’ profitability, taking into account the “proprietor’s” (owner’s) wage.

PEBITDA = EBITDA (addback) + One Proprietor’s Wage

The standard practice is to add back only one proprietor’s wage should there be multiple owners.

For the three examples above, all other factors being equal across all three businesses (meaning we apply the same multiple to the PEBITDA—for example, 2.5), the buyer is purchasing a business with profits for their efforts (the proprietor’s wage) of $X—if they can continue performance at the same level. See below for extended examples.

Remember: PEBITDA = EBITDA (addback) + One Proprietor’s Wage

Business 1: PEBITDA = EBITDA ($10,000) + Proprietor Salary ($145,000) = $155,000

The next important question is this: are the wages of the proprietor “market value”? The answer to this question then helps the potential buyer understand what profitability there will be if they pay someone a market salary to manage the business. See the below example.

In each of the businesses, the market wage of the proprietor is the same.

Important note:A business that can create enough profits to remove the involvement of the owner and have a significantly positive EBITDA should have a higher multiple applied when identifying the enterprise value than a business that needs to use PEBITDA to generate a significant enough positive PEBITDA.

The reason is because in the PEBITDA example, the owner is still involved in the running of the business day to day (in other words, like an employee) to receive a wage/profits (and this is a less attractive sales proposition).

Comparing Businesses 1 and 3 from the examples:

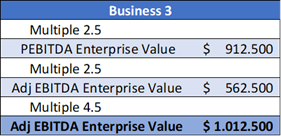

- A higher multiple should be applied to Business 3 based on the adjusted EBITDA than Business 1 based on PEBITDA.

- This is because a business that can generate $225,000 in profits without the owner needing to work in the business themselves day to day in order to generate $145,000 (as with Business 1) is more valuable.

- This information is not known by simply looking at EBITDA without taking into account the owner’s wage.

So how do you identify what the difference would be in the multiple between EBITDA versus PEBITDA for the same business?

Take Business 3, for instance. Applying the same multiple to the PEBITDA or adjusted EBITDA gives you a very different enterprise value. Is this correct? Obviously not. A higher weighting should be placed on the metric “Adjusted EBITDA”, because the owner will receive profits without having to work daily for them.

The applied multiple obviously has many variables that are considered and that can influence the multiple ultimately applied to the earnings metric. This exercise is on the basis that all other factors are considered equal.

Identifying the delta, or difference in the change, between an EBITDA and PEBITDA multiple is not as simple as a pure sliding metric or a constant percentage increase across the board. There are a number of variables that need to be considered. This requires the expertise and discretion of industry professionals to establish a fair adjustment.

Here at InteleK, this analysis is something that will continue to evolve and be refined. Hopefully this article will generate discussions with industry professionals that will shed some new light on the topic, and we can then continue refining the process.

In Summary

- EBITDA or EBIT as an earnings metric in a company valuation is traditionally more useful for larger companies in which the EBITDA is positive and not significantly impacted by the salary or wages of the owner/director.

- PEBITDA (as the earnings metric to apply an appropriate multiple to) becomes more appropriate for small businesses in which the owner/director is heavily involved in the daily operations of the business, as well as their wages and personal expenses through the business, heavily influence the EBITDA figure.

- In the PEBITDA calculation, the identification of fair market wages for the position of the owner/director needs to be factored in.

- All other factors considered equal, a weighting to the multiple used for EBITDA or EBIT to PEBITDA or PEBIT needs to be applied. What this weighting is and how it is calculated requires expertise and discretion of industry professionals to establish a fair adjustment.

PEBITDA is often the most appropriate earnings metric to use when analysing small- to medium-sized businesses as part of a business valuation. It is more appropriate than the traditional business valuation techniques or methods reserved for larger business, which do not adequately reflect the unique circumstances of SME. Using appropriate techniques and earnings metrics is key in developing accurate and justified business valuations.