Cost of Equity & Cost of Debt

Cost of Equity

The cost of equity is the rate of return an investor expects to receive as compensation for the risk associated with owning the stock or shares of a company.

In comparison with the cost of debt, in which interest payments and repayment of principal are defined in a contract, the cost of equity does not need to be repaid (it is not an obligation, such as a debt contract with the bank) and is at the discretion of the company. As a result, the cost of equity is higher than the cost of debt, due the subordinated nature of equity holders in the capital structure. Debt holders legally must be repaid before shareholders (equity investors) when distributing company profits or in the event of the closure of a company and liquidation of company assets. Therefore, the cost of equity is higher than debt, due to its higher risk nature and uncertain cash flows, generating a higher rate of return.

Purpose

The purpose of identifying the cost of equity is to describe for equity investors the relationship between the risk and expected return for assets. With the cost of equity, investors agree to invest in a company only if the expected return compensates for the expected risk they have taken by making that investment.

Cost of Debt

The cost of debt is the price of servicing the interest and principal payments of obligations, such as loans, credit cards, bonds, and other forms of debt to raise capital for a company. The cost of debt is far simpler than cost of equity to identify, understand, and measure for companies. It has the least level of risk for investors, and therefore generally offers the lowest rate of return. For companies acquiring debt in order to fund their operations, the cost is lower than the cost of equity; however, the repayments are an obligation and are legally binding. Due to the differences in risk and return and the overall cost of funding operations with debt or equity, strategic decision making is required by the company’s boards, shareholders, and executives.

Tax Advantage/Shield

Interest payments made on a debt source by a company are tax deductible. This is applicable regardless of the underlying debt investment—whether it be in the form of bank loans, bonds, or other debt securities. The interest payments reduce a company’s profit by the amount of the interest payments, effectively lowering the company tax burden by an amount equal to the corporate tax rate multiplied by the interest amount.

Purpose

The purpose of identifying the cost of debt is to measure the overall rate that a company pays on its debt obligations using the different types of debt financing. Knowing a company’s cost of debt enables the company (and other users) to perform a comparable assessment of the company’s cost of debt with alternative debt sources, against industry averages and in the economy as a whole. This knowledge allows the company to then obtain the best source of debt funding for their operations and investors.

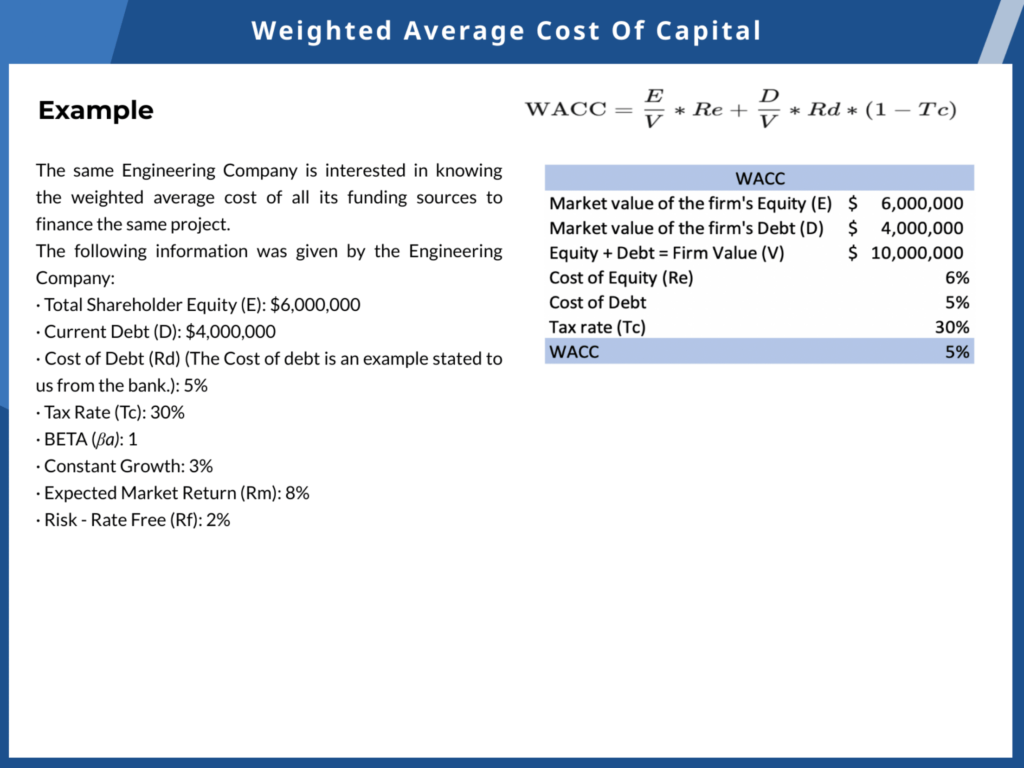

Cost of Capital

The cost of capital is the risk-weighted cost of all funding sources to finance a company’s assets. It covers the overall cost of debt and equity, which can be derived from the weighted average cost of capital (WACC). This cost is the risk-weighted rate of return, required by all providers of capital, to make a given investment in a specific project or a company as a whole. Therefore, a company (and investors alike) will analyze if it is worth investing (providing capital) in a certain project by expecting a risk-adjusted return, as calculated using the WACC on the money they’ve invested.

Project Decision Making Using WACC

One main purpose is to calculate the return a company needs in order to proceed with a project, such as purchasing new equipment or constructing a new building for a business. In making this important capital decision, a company should consider the cost of equity (by raising funds from shareholders) as well as debt (by selling bonds, borrowing money, etc.) to finance the investment that a company must make for a specific business project or investment.

What Sources of Capital Are Considered?

The WACC is the calculation of a firm’s cost of capital, in which each category of capital is proportionately weighted. For instance, all sources of capital (both equity and debt) including common stock, preferred stock, bonds, and any other long-term debt.

Is It Better to Raise Capital as Debt or Equity?

Businesses need to determine how to make the best use of these funding sources, debt and equity, to create and operate their business. This decision depends on a myriad of factors and variables beyond the scope of this article. At a high level (depending on the macroeconomic factors), industry, strategic direction of the business, risk profile of the business, its life cycle stage, views of shareholders, specific project risks, and more will affect how the company funds their operations (either with debt or equity, or a mixture of both). A company with a moderate risk profile generally has a combination of both debt and equity to fund their operations, spreading the risk across both funding sources.