Discount For Lack of Control

When performing a business valuation, several discounts should be considered that may need to be applied to a business’ value. Below, we will explain what a discount for lack of control means, as well as when an investor, appraiser, or other users of valuation information should be aware of it.

DLOC Valuation

The DLOC is a discount applied to the value of a company when an investor purchases or holds a minority amount of the total amount of shares issued, and therefore lacks decision-making power. This is in comparison to a majority shareholder, who benefits from the ability to control decisions within the company and thus has an associated control premium attached to their majority shareholding.

What’s the Purpose of the Discount for Lack of Control?

The purpose of the discount is to establish the value of the minority interest, due to the lack of control and decision-making ability. Often, the company is valued as a whole, after which a discount will be applied relative to the company’s whole value for the minority interest. If there are only two shareholders, the remaining value is attributable to the majority shareholder and captures their control premium.

To find the original whole value of the company, in order to apply the DLOC to, see our article that explains this process, “How do I Value My Business?”.

Example of the Discount for Lack of Control Formula

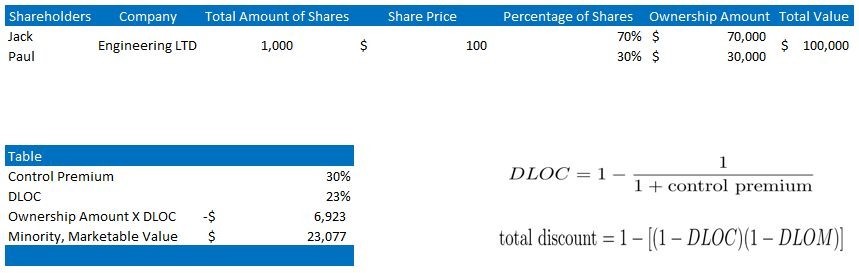

Engineering Ltd. has two shareholders, Jack and Paul. The company has been valued in total at $100,000. Paul is seeking to sell his percentage of ownership that covers 30% of the total amount of shares (meaning he’ll have a minority control interest, while Jack will have the majority controlling interest). An investor is interested in valuing Paul’s ownership, including a discount for lack of control for holding the minority of the total amount of shares.

Note: For the above example, we assumed a 30% control premium. This is established by analyzing the control premiums paid from acquisitions of public companies compared with noncontrolling interests. The DLOC was then calculated using the formula above, for a total of 23%. This is an absolute discount of $6,923, and the total minority value is $23,077.

Conclusion

Discount for lack of control should be applied to shareholdings of investors who hold a minority interest of a company. It is important to use relative statistics (historical control premiums) in developing a DLOC and determining if it is applicable to your business’s valuation.